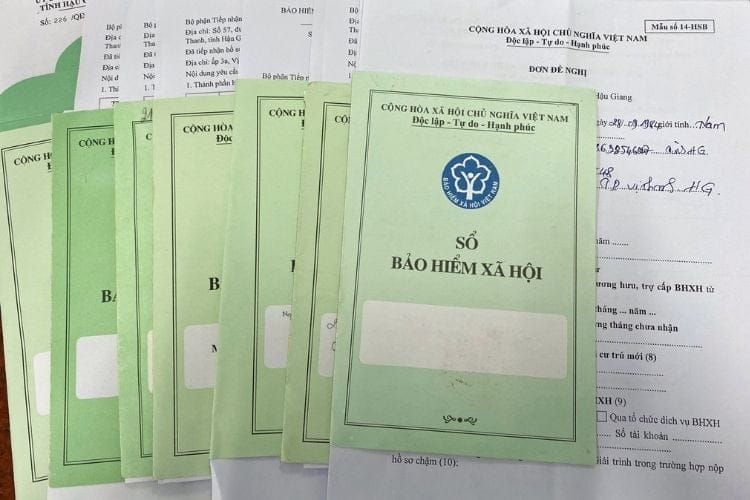

When the labor relationship has ended, to enjoy social insurance benefits (such as unemployment insurance, one-time social insurance) or to continue working at another company without getting into trouble. When it comes to participating in insurance, closing the social insurance book is an important and necessary procedure.

1. Can employees close their own insurance books?

According to the provisions of Point a, Clause 3, Article 48 of the 2019 Labor Code , the employer is responsible for completing the confirmation procedure and returning the social insurance book and a number of other documents.

The employer coordinates with the social insurance agency to return the social insurance book to the employee. Next, the employer reconfirms the social insurance payment period when the employee terminates the contract. This is stipulated in Clause 5, Article 21 of the 2014 Law on Social Insurance .

Thus, it can be seen that employees cannot carry out the procedure to close their own social insurance books. Closing social insurance books for employees belongs to the employer. Except for some cases where businesses are in bankruptcy and insurance debt cannot be paid.

Once the labor contract with the employee has been terminated, the business should quickly close the social insurance book for the employee. If you do not close the social insurance book for too long, you will be fined.

2. Procedures for closing social insurance books for employers

Procedures for closing social insurance books are carried out based on the steps specified in Article 23 of Decision 595/QD-BHXH . As follows:

2.1. Implement labor reduction notification

Before closing the social insurance book, the employer must carry out procedures for reporting a reduction in employees participating in social insurance. In the dossier preparing to report a reduction in labor participating in social insurance, it is necessary to include:

– Declaration to adjust social insurance and health insurance information according to form TK1-TS.

– Declaration for the unit to adjust social insurance and health insurance information according to form TK3-TS

– List of employees participating in social insurance; Health insurance; accident insurance; occupational accident insurance; occupational disease. Use form D02-TS

– Statement of information, use form D01-TS

– Social insurance card of the employee but must still have an expiry date. Regulations that each employee needs to have 1 copy

Enterprises need to complete all of the above documents and send them to the social insurance agency. When the enterprise has successfully reported the reduction, the next step will be to prepare the application for closing the social insurance book.

2.2. Closing the social insurance book

When carrying out the procedure for closing the social insurance book, the employer needs to prepare the following documents:

– Declaration of the participating unit, adjusting social insurance and health insurance information. Use form TK3-TS

– List of workers participating in social insurance; Health insurance; unemployment insurance; occupational accident insurance; Occupational diseases according to form D02-TS

– Information list based on form D01-TS

– The employee’s social insurance book can use the old form or use the new form of social insurance leaflet. In cases where employees have participated in social insurance many times, businesses need to prepare separate covers of social insurance books.

– Official dispatch on closing the social insurance book of that unit (form D01b-TS)

2.3. Form of application for finalization of social insurance book

Once all documents have been completed, businesses can send them to the social insurance agency online. Use social insurance software to send or businesses can send by post to have their documents processed.

The time to confirm the social insurance book must not exceed 5 days. Calculated from the date the social insurance agency received the dossier according to regulations

2.4. Deadline for completing social insurance book closing documents

Within 7 working days from the date of termination of the labor contract, the enterprise must complete the closing procedures for the employee. For special cases, it may be possible to extend the closing time. But it cannot last more than 30 days.

In short, when employees quit their jobs or terminate their labor contracts, they will not be allowed to close their own social insurance books. The employer is responsible for closing the social insurance books for employees in accordance with regulations.