In the process of personal financial management, ensuring tax payment on time and in full is one of the most important things to avoid legal and financial problems. However, sometimes tax debt may occur due to many different reasons. To solve this problem simply and quickly, looking up information about personal income tax debt becomes extremely important. In this article, we will learn about how to look up personal income tax debt in the simplest and fastest way, helping people confidently control their personal financial situation effectively. .

1. The simplest and fastest way to look up personal income tax debt

Method 1: Look up on the website of the General Department of Taxation

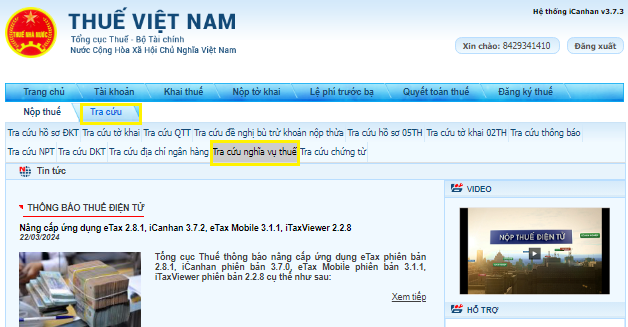

Step 1: Access the Electronic Information Portal of the General Department of Taxation

To start the process, Taxpayers (NNT) access the website of the General Department of Taxation at https://thuedientu.gdt.gov.vn/. They then select the “Personal” tab followed by “Sign In”. Taxpayers can use the Ministry of Public Security’s Electronic Identification account or Electronic Tax account to log in. In case you do not have an account, you need to register with your tax code information along with your citizen identification number.

Step 2: Select Look up and select Look up tax obligations

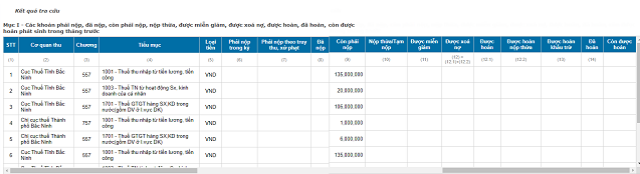

After successfully logging in, taxpayers select “Look up” and then select “Look up tax obligations”. Here, the system will display two important items:

– Section I: Includes information about taxes payable, paid, still payable, overpaid, exempted, forgiven, refunded, refunded, and still to be refunded.

– Section II: Displays outstanding taxes, overpayments, and amounts recorded in the tax management system.

At this step, taxpayers can look up detailed information such as the amount of tax paid (refunded), the amount of tax payable, and many other information related to their tax obligations.

Method 2: Look up on the eTax Mobile application

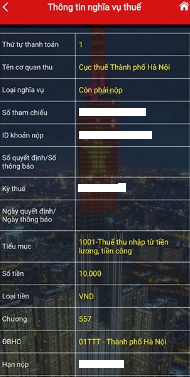

Step 1: Log in using your registered account or a new one

First, the Taxpayer (NNT) logs into the system with the registered account. In case they do not have an account, they can register a new one by providing their tax code information and citizen identification number.

Step 2: Select Look up tax obligations and perform the Look up

After successfully logging in, taxpayers select “Look up tax obligations” and then select “All tax obligations” to perform the lookup. Here, the system will display two important items:

– Section I: Lists information about taxes payable, paid, still payable, overpaid, exempted, forgiven, refunded, refunded, and still to be refunded.

– Section II: Displays information about taxes still payable, overpayments, and amounts recorded in the tax management system.

At this step, taxpayers can click on the “view details” button to check specific information about whether they receive a tax refund or need to pay additional taxes, including the specific amount in both sections.

2. Taxpayers and enforcement measures

According to the provisions of Clause 1, Article 2 of Circular 215/2013/TT-BTC, taxpayers will face tax enforcement measures in the following situations:

- When tax debt or late tax payment exceeds 90 days from the date of expiry of the payment deadline or the expiration of the tax payment extension period according to the provisions of the Law on Tax Administration and competent state agencies.

- When you still owe taxes, fines, late tax payment interest and there is an act of absconding or dispersing assets.

- When failing to comply with a decision to sanction tax administrative violations within 10 days from the date of receipt of that decision, the taxpayer will face enforcement measures to enforce that decision.

See more Can people be banned from leaving the country without completing their tax obligations?

If the time limit for implementing a decision to sanction tax administrative violations lasts more than 10 days and the taxpayer does not comply, they will also be subject to enforcement measures to enforce that decision (except in cases of postponement or temporarily suspend the implementation of that decision).

3. Cases of personal income tax debt cancellation

According to the provisions of Article 85 of the Law on Tax Administration 2019, cases of tax debt forgiveness, late payment interest, and fines are described as follows:

- An individual who has passed away or has been recognized by the Court as having passed away or lost the ability to act civilly has no assets, including inheritance assets to pay taxes, late payment interest, and outstanding fines.

- Tax debts, late payment interest, and fines of taxpayers that do not fall into the above cases but tax authorities have applied enforcement measures as prescribed in Point g of Clause 1, Article 125 of the Law on Tax Administration 2019, and these debts have exceeded 10 years from the tax payment due date without the possibility of recovery.

Taxpayers whose tax debt, late payment interest, and fines have been written off according to this regulation before restarting production and business activities or establishing a new facility must repay the State the tax debt amount. , late payment interest and fines have been removed.

- Taxes, late payment interest, and fines for cases affected by natural disasters, catastrophes, or large-scale epidemics have been exempted from late payment fees according to the provisions of Article 59, Clause 8 of the Law on Management. Tax for 2019, and has been extended tax payment according to the provisions of Point a, Clause 1, Article 62 of the Law on Tax Administration 2019, but still suffers irrecoverable damage to production and business and is unable to Pay taxes, late payment interest, and fines.

4. Criminal liability for personal income tax evasion

According to the amendment of Point a, Clause 47, Article 1 of the Law amending the Penal Code in 2017 and Clause 1, Article 200 of the Penal Code in 2015, workers can be prosecuted for criminal liability for evasion. tax in the following cases:

- Failure to submit tax registration documents.

- Failure to submit tax returns.

- Submit your tax return 90 days after the deadline for payment or the extension of payment according to the provisions of law.

The above acts must fall into one of the following cases:

- Tax evasion with an amount from 100,000,000 VND to under 300,000,000 VND.

- Tax evasion under VND 100,000,000 but has been sanctioned for administrative violations of tax evasion.

- The worker was convicted of tax evasion which he still violated.

- The employee has been convicted of one of the other crimes as prescribed in the 2015 Penal Code, which he also violated.

Penalties for tax evasion are prescribed as follows:

- Fine from 100,000,000 VND to 500,000,000 VND or imprisonment from 03 months to 01 year.

- More serious cases may result in a fine from 500,000,000 VND to 1,500,000,000 VND or imprisonment from 01 year to 03 years.

- If the amount of tax evasion is 1,000,000,000 VND or more, you may be fined from 1,500,000,000 VND to 4,500,000,000 VND or imprisoned from 02 to 07 years.

- In addition, the offender may also be fined from 20,000,000 VND to 100,000,000 VND, banned from holding certain positions, practicing certain occupations or doing certain jobs for 01 to 05 years, or having part of his/her income confiscated. or all assets.