Adjustment of Investment Registration Certificate is a procedure carried out at the investment registration authority to record changes in the project’s content or changes in investors in the Investment Registration Certificate. According to the provisions of Investment Law of Vietnam 2020, when there is a change in the project or investor, the company must carry out the procedure to adjust the Investment Registration Certificate.

1. Cases requiring adjustment of the Investment Registration Certificate

- Change of investment project name.

- Change of investor information, change of investor.

- Change of project implementation location, land area used.

- Change of investment project objectives, scale.

- Change of investment project capital (including investor’s contributed capital, meaning increase or decrease in charter capital, and mobilized capital, meaning increase or decrease in investment capital).

- Change of operation term of the investment project.

- Change of investment project implementation schedule, including:

- Capital contribution and mobilization schedule;

- Schedule for implementing the main operational objectives of the investment project; if the investment project is divided into stages, the implementation schedule for each stage must be specified.

- Change of investment incentives, support forms, and application conditions/bases (if any).

- Change of conditions for investors implementing the investment project (if any).

When an enterprise carries out the procedure for adjusting its Investment Registration Certificate, it also needs to change relevant content in its Enterprise Registration Certificate. Companies with a Business License also need to carry out the procedure for changing their Business License.

2. Authority to carry out procedures for adjusting Investment Registration Certificate

2.1. Provincial Department of Planning and Investment where the company is headquartered

- Investment projects outside industrial parks, export processing zones, high-tech parks, and economic zones;

- Investment projects for developing infrastructure of industrial parks, export processing zones, high-tech parks, and investment projects within industrial parks, export processing zones, high-tech parks in localities where the Management Board of Industrial Parks, Export Processing Zones, and High-Tech Parks has not yet been established.

- Investment projects implemented in multiple provinces or centrally run cities;

- Investment projects implemented simultaneously inside and outside industrial parks, export processing zones, high-tech parks, and economic zones.

2.2. Management Boards of Industrial Parks, Export Processing Zones, High-Tech Parks, and Provincial Economic Zones where the company is headquartered

- Investment projects for developing infrastructure of industrial parks, export processing zones, high-tech parks;

- Investment projects implemented within industrial parks, export processing zones, high-tech parks, and economic zones.

3. Dossier for adjusting Investment Registration Certificate

3.1. Applicable in ordinary cases, i.e., for projects not requiring an Investment Policy Decision

- Written request for adjustment of the Investment Registration Certificate;

- Report on the implementation status of the investment project up to the time of adjustment;

- Investor’s decision on the adjustment of the investment project for organizational investors or equivalent document for individual investors;

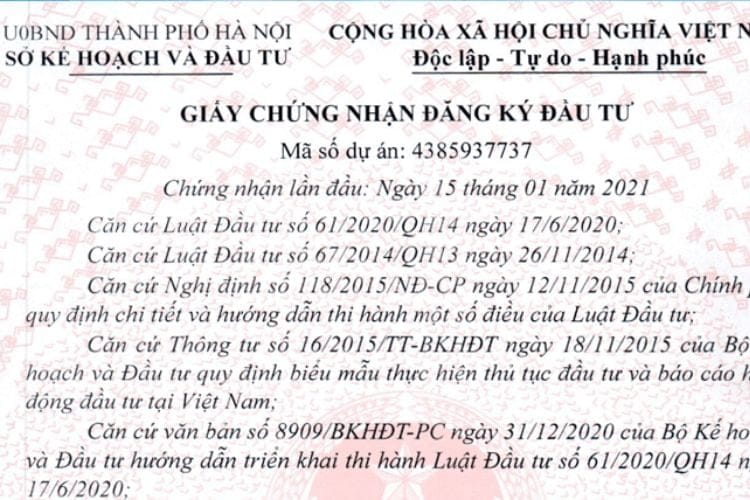

- Current Investment Registration Certificate;

- Audited financial statements of the company for the immediately preceding year at the time of adjusting the Investment Registration Certificate;

- Investment project proposal including the following main contents: investor or investor selection method, investment objectives, investment scale, investment capital and capital mobilization plan, location, term, implementation progress, information on the current land use at the project implementation site and proposed land use needs (if any), labor needs, proposed investment incentives, economic – social impacts and effectiveness of the project, preliminary environmental impact assessment (if any) in accordance with environmental protection laws. If construction law requires a pre-feasibility study report, the investor may submit the pre-feasibility study report instead of the investment project proposal;

- If the investment project does not propose the State to allocate land, lease land, or permit change of land use purpose, a copy of the land use right certificate or other documents proving the right to use the location for project implementation must be submitted;

- Explanation of the technology used in the investment project for projects subject to appraisal and consultation on technology in accordance with technology transfer laws;

- BCC contract for investment projects in the form of BCC contracts;

- Other documents related to the investment project, requirements on investor conditions and capacity as stipulated by law (if any).

- Explanation or provision of documents related to the adjustment of the following contents:

3.2. In case of changing investor information

The company needs to provide documents on the legal status of the investor related to the change:

- Operation certificate of the parent company for organizational investors;

- Investor’s passport if the investor is an individual;

3.3. In case of changing the charter capital or investment capital of the project

Documents proving the financial capacity of the investor include at least one of the following documents:

- Financial statements of the investor for the most recent 02 years;

- Financial support commitment from the parent company or;

- Financial support commitment from a financial institution or;

- Guarantee of the investor’s financial capacity or;

- Other documents proving the investor’s financial capacity;

3.4. In case of changing the project implementation location or land area used:

The company needs to provide additional documents:

- Land lease contract, office lease contract registering the project implementation location;

- Land use right certificate of the lessor or of the investor or other substitute legal documents;

- If leasing land or office from another enterprise, additionally provide the Enterprise Registration Certificate of the lessor with real estate business functions.

4. Procedure for adjusting Investment Registration Certificate

4.1. Procedure for adjusting Investment Registration Certificate without new members or shareholders contributing capital

The procedure for adjusting the Investment Registration Certificate is carried out in the following steps:

- Step 1: Carry out the procedure for adjusting and issuing the Investment Registration Certificate (old investment project part) according to investment procedures;

- Step 2: Change relevant content on the Enterprise Registration Certificate.

- Step 3: Adjust or re-issue business condition licenses such as: International travel business license / Food safety facility condition license / Foreign language center, study abroad operation license / Business license (Only applicable to enterprises adding business lines for retail distribution of goods, leasing of goods, and other business lines as specified in Decree 09/2018/ND-CP)…

4.2. Procedure for adjusting Investment Registration Certificate when a new foreign investor contributes capital, purchases shares, or capital contributions in the company

- Step 1: The investor submits the dossier to the investment registration authority where the economic organization is headquartered to carry out the procedure for registering capital contribution, share purchase, or capital contribution in a foreign-invested company;

- Step 2: The investor submits the dossier to the business registration authority to carry out the procedure for recording investor information on the Enterprise Registration Certificate (If the enterprise has not separated the Investment Registration Certificate and the Enterprise Registration Certificate, they will simultaneously carry out the separation procedure in Step 2. The Enterprise Registration Certificate number is also the tax identification number of the enterprise that has been issued);

- Step 3: If the enterprise’s legal seal needs to be re-issued according to the information on the Enterprise Registration Certificate (i.e., the enterprise’s tax identification number) to match the current record of the domestic enterprise.

- Step 4: Carry out the procedure for adjusting the Investment Registration Certificate to update information of the new investor along with the adjustment contents related to the investment project.

- Step 5: If the investor adds conditional business lines, the information on the Enterprise Registration Certificate will continue to be changed through the procedure for changing the Enterprise Registration Certificate at the business registration authority;

- Step 6: Apply for a business condition license for conditional business lines as stipulated by specialized law.

5. Time limit for carrying out procedures for adjusting Investment Registration Certificate

Typically within 10 working days from the date of receiving a complete and valid dossier.

Notes when adjusting the Investment Registration Certificate:

- For enterprises that have not separated the Investment Registration Certificate into an Enterprise Registration Certificate, they must carry out the procedure to separate the Investment Registration Certificate.

- After adjusting the Investment Registration Certificate, the enterprise needs to carry out some procedures to avoid unwanted legal issues such as:

- If the enterprise changes to include a new capital contributing member, it should be noted that the new investor must contribute investment capital to the enterprise’s capital transfer account and ensure timely contribution according to the committed schedule in the Investment Registration Certificate. In case the investor fails to contribute capital on schedule as committed in the Investment Registration Certificate, the enterprise must carry out the procedure to extend the capital contribution period and will be fined according to legal provisions.

- Enterprises should pay attention to reporting procedures and report forms in accordance with the recorded content and the enterprise’s investment reporting obligations (usually stipulated in Article 3 of the Investment Registration Certificate);

- For newly adjusted conditional business lines, enterprises are advised to ensure compliance with the conditions during operation.