The concept of “virtual currency” is no longer strange to investors in Vietnam. The number of investors participating in this investment channel is tending to increase. As a result, the number of articles and analyzes about virtual currencies is also increasing. However, current legal analysis articles on virtual currencies tend to have fragmented content, are not comprehensive and sometimes even confuse readers. The writer himself has been in the process of researching this investment channel and is fortunate to have useful legal information. Therefore, the writer wishes to share this information in a summary and comprehensive way, hoping it will be useful to everyone.

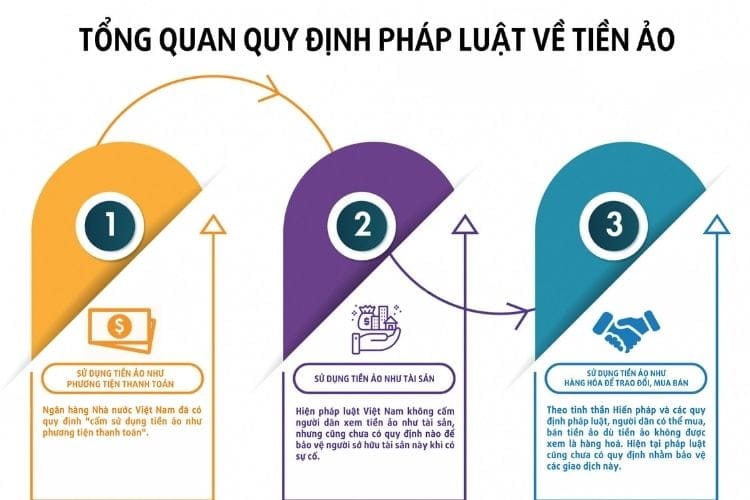

Currently, activities related to virtual currency in Vietnam are divided into 3 large areas:

- Use virtual currency as a means of payment;

- Use virtual currency as assets; and

- Use virtual currency in business and commercial activities.

1. About using virtual currency as a means of payment

Using virtual currency as a means of payment is when an individual uses virtual currency in exchange for another good or service.

For example, when buying goods such as a computer in Vietnam, instead of paying in cash in Vietnamese Dong or bank transfer, the buyer uses Bitcoin to pay the seller.

Using virtual currency (Bitcoin) as a means of payment mentioned in the example above is prohibited behavior. Currently, the Vietnamese legal system in the fields of banking, currency and means of payment has clear regulations; and the State Bank of Vietnam has also issued detailed instructions and announcements on banning the use of virtual currency as a means of payment. If this regulation is violated, the operator may be held criminally responsible.

2. Regarding the use of virtual currency as assets

An example of using virtual currency as an asset is when an individual has some Bitcoin and gives it to another person.

According to many analysis articles, virtual currency is not considered a type of asset according to the current Civil Code 2015. But currently, Vietnamese law does not prohibit people from using virtual currency as property, however there are no regulations to record this content. This means that the State does not have regulations prohibiting the accumulation of virtual currency, but there is also no mechanism to protect virtual currency owners when an incident occurs.

Therefore, using virtual currency as an asset is currently possible, but there will be many risks. As in the example above, if the donor for some reason does not make the donation, the recipient also has no mechanism to protect his or her rights.

The risk when using virtual currency as an asset not only comes from the fact that the exchange platforms can collapse and price fluctuations are not managed, but the risk can also come from the parties having civil transactions related to the property. and when one side does not comply, it is difficult for the other side to have a mechanism to protect its rights. Although the Court can still accept and adjudicate these cases even though there are no legal regulations, the risk lies in the difficulty and lack of mechanism to enforce the Court’s decisions.

3. About using virtual currency as a commodity to buy and sell

This is probably the most frequent activity in Vietnam. When a trader buys and sells virtual currency for the purpose of making a profit, that trader is considered to be doing business.

According to legal regulations on investment, business and trade, individuals and organizations can do business in professions that are not prohibited by law. And currently there are no regulations banning the virtual currency business. Therefore, according to the spirit of the Constitution and legal regulations, people can trade virtual currency.

But even though there are no prohibitions, the law does not have any regulations regulating the virtual currency business. Furthermore, according to Commercial Law 2005, virtual currency is not considered a commodity to be exchanged, bought, or sold. Therefore, people using virtual currency in business activities will have the same financial and legal risks as using virtual currency as an asset.

However, because there are currently no regulations on this issue, although virtual currency trading has been generating profits for investors, investors are not forced to fulfill tax obligations on this issue. this income. Evidence for this content is that in September 2017, the People’s Court of Ben Tre province issued a decision to cancel the decision of the Ben Tre City Tax Department on the collection of value added tax and personal income. for an individual participating in a virtual currency exchange. According to the Trial Chamber, tax collection implicitly considers this currency a commodity, while the law does not consider virtual currency a commodity, which is inappropriate.

Anticipating the continuous development of this investment channel, on August 21, 2017, the Prime Minister issued Decision No. 1255/QD-TTg on approving the project to complete the legal framework for management, Handling virtual assets, cryptocurrencies, virtual currencies. So in the future, investors may have their rights better protected by law in virtual currency investment activities. However, every right comes with an obligation. If there are regulations on virtual currency to protect investors, then regulations on tax collection on income from this investment channel will certainly also be issued.